Superfans: The Billion-Dollar Game Changer

Everyone is talking about superfans and the $4 billion opportunity - but what is the current status? And who has the best chance of taking the throne? Here are the answers.

The music world has (once again) reached a historically important point. The next stage of evolution is about to take place, and the evidence is clear that superfans play an important role in the new world of music. But what makes superfans what they are? What are the market opportunities for DSPs, artists and labels? And how can they be realized? In this article I would like to explore the topic from different perspectives. One thing should be said in advance: the whole thing resembles an episode of Game of Thrones due to the interconnections, including an outstanding cliffhanger. So let's take a look at the contenders for the throne.

The Throne in numbers 💰

As you will see, the major players in the music industry are (finally) focusing on superfans. The reason is obvious: as so often, it's all about the money.

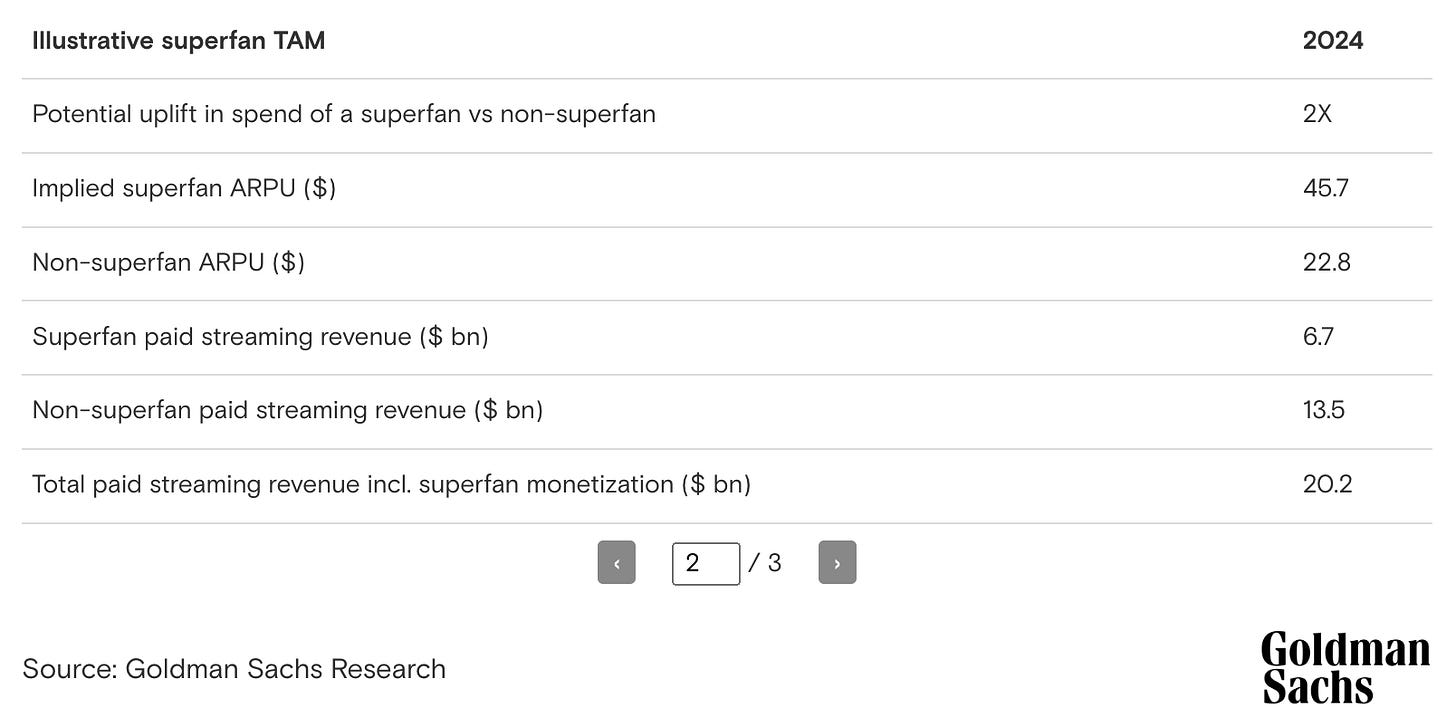

According to Goldman Sachs, there's potential to boost revenue through "superfan segmentation," recognizing different levels of engagement with streaming platforms and artists. This could be a $4 billion opportunity, with projected incremental revenue of $2 billion by 2027 and $4 billion by 2030.

The biggest major is the Universal Music Group. In January 2024, the company released a memo that could not be more relevant to this article. Chairman and CEO Sir Lucien Grainge announced what the world's largest music company will focus on in 2024. As always, it might be worth taking a closer look. In particular, he said:

“THE NEXT FOCUS OF OUR STRATEGY WILL BE TO GROW THE PIE FOR ALL ARTISTS, BY STRENGTHENING THE ARTIST-FAN RELATIONSHIP THROUGH SUPERFAN EXPERIENCES AND PRODUCTS.” — Sir Lucien Grainge

The Brit also made it clear that UMG's strategy will now focus on "strengthening the relationship between artists and fans," particularly through "superfan experiences and products," following last year's focus on getting streaming platforms to adopt an "artist-centric" approach. Sounds lucrative.

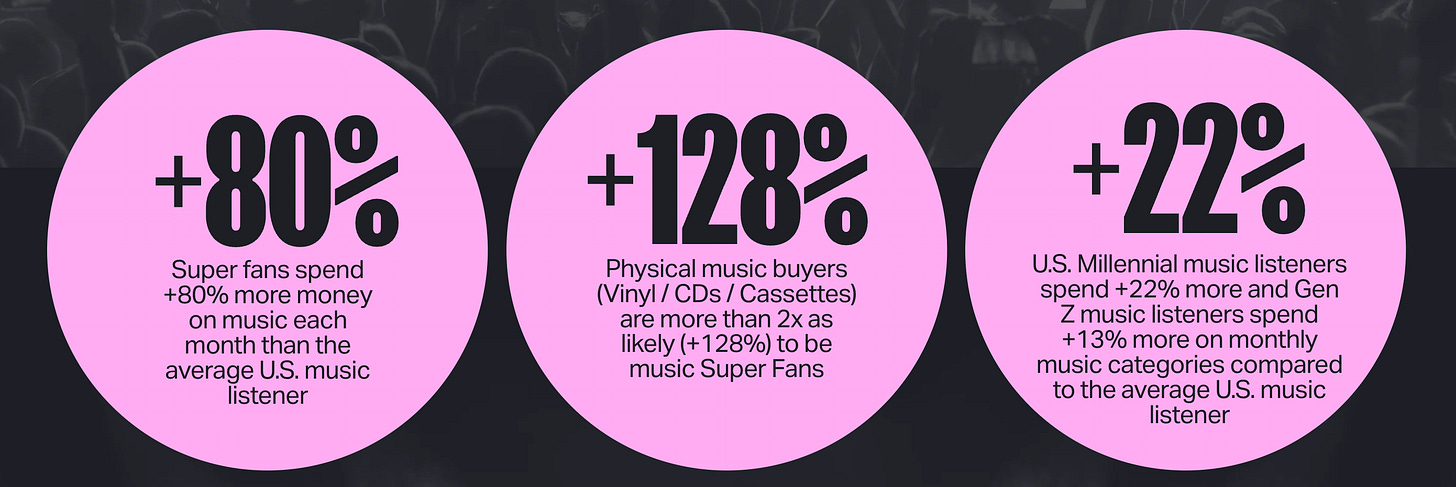

According to Luminate's 2023 year-end report, 18% of all music listeners in the U.S. market qualify as superfans. They spend 80% more on music each month than regular fans.

Despite all the nice numbers, we should not forget what is really important: a real community! If artists can build that, the sales process is much easier. The Luminate report also shows that 43% of superfans like to meet within the community to exchange ideas. I think this is something that's not really developed yet.

Player 1: DSPs on their way to a warm money shower? 📈

Money doesn't fall from the sky, at least not where I live, in Berlin. It's mostly just rain here. Our first player in the superfan game are the DSPs. They have been struggling for profitability for ages and it seems that superfans can help them find the holy grail. But how can the streaming providers around Spotify make their business models profitable in the future if no Benjamins automatically fall from the sky? Spoiler: Rain dances are not the answer.

One effective way to move toward profitability in 2023 was to break with a long "tradition" for the first time, which was that the $9.99 limit for a premium subscription was not exceeded in Western Europe and North America. While video streaming platforms have increased their pricing, the music industry has held back. Why? We don't really know, but it could have something to do with the fear of losing customers. The French service Deezer was the first provider in the world to take the dive into the deep end.

The bold move by the departing CEO Jeronimo Folgueira paid off, because contrary to many fears within the industry, Deezer lost almost no paying customers. Probably one of Folgueira's riskiest, but also most successful maneuvers. This was probably also the final "proof of concept" for the other services, whereupon prices were also increased.

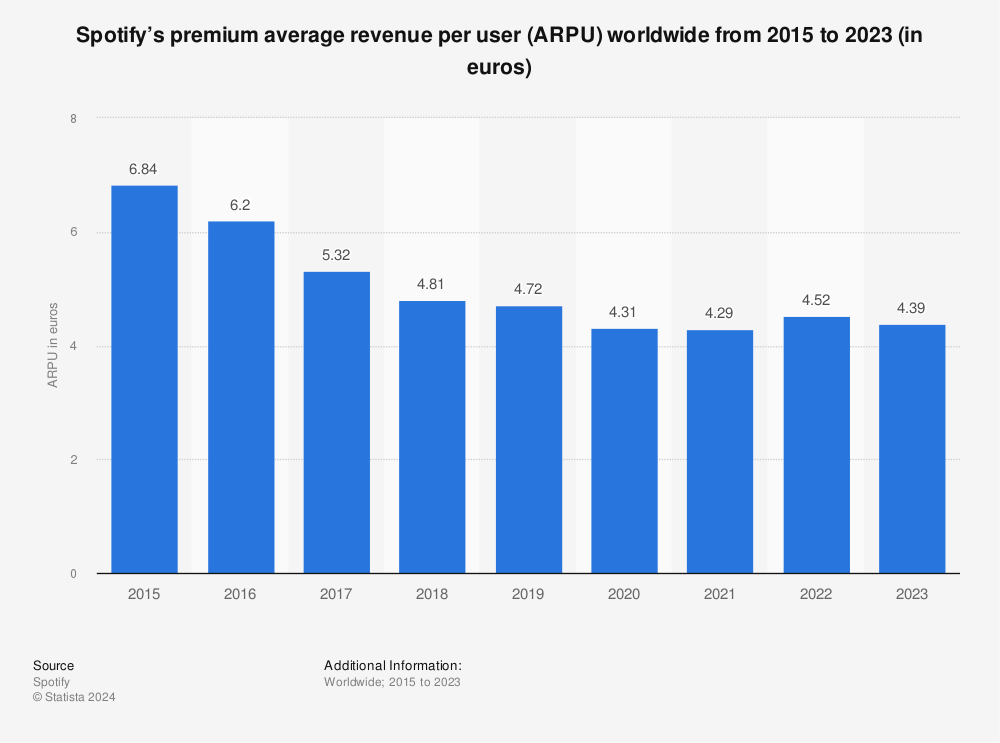

To achieve profitability, one metric is particularly important: ARPU (average revenue per user). ARPU for all DSPs has been declining in recent years, by 40% since 2016. This is obviously problematic. Price increases naturally lead to an increase in ARPU. But this "tool" is also relatively limited, so it cannot be the only solution on the road to profitability. So the question is: how to better monetize existing users?

If we look at Spotify's 2023 results, we see that the premium ARPU has decreased compared to the previous year. This is due to the fact that family subscriptions or other discounts are included. If you want to increase the total number of paying users (there are currently 236 million premium subscribers on Spotify, which corresponds to an increase of 31 million compared to the previous year), the best way to do this is through discounts.

The challenge is obvious: a) users with free accounts must unsurprisingly be converted into premium subscribers, because the ARPU is logically much higher here and b) ARPU needs to be increased in both categories (i.e. free + premium) in order to get closer to the goal of economic profitability.

Costs must be reduced in the low-margin business for Spotify and similar services (Spotify paid out 63% of their total revenues to music rights holders in 2023) in order to become profitable. Not an easy balancing act.

In addition to the price increases mentioned above, which we will certainly see in 2024, the ARPU of premium subscribers will also focus on a potential target group that has been less actively approached in the past: superfans.

This is also known in Sweden, where the brains at Spotify's Stockholm headquarters are probably already working on concepts to monetize superfans. At the moment, however, you still have to be patient because the potential of superfans cannot really be monetized yet. The problem? Let me put it this way: Have you ever wondered why you can't change your subscription (from Duo to Single, for example) in the app on your iPhone? It's because in most countries around the world, Apple charges app developers (in this case, Spotify) a 30% fee for each in-app purchase, and Spotify is not willing to share that money with Apple. Considering that Spotify paid $9 billion of its revenue to rights holders in 2023, the margin in such a scenario would probably be the nail in the coffin for DSPs sooner or later.

This is why there is currently a public exchange of blows between Apple, Spotify and the EU. I don't want to go into this any further here, as it is relevant but has little significance for your "aha experience" after reading it. For the rest of this article, we will simply assume that the problem will be solved soon and microtransactions will be possible in the Spotify app on smartphones.

First superfan approaches from Spotify

Well, we now know that superfans are an interesting target group, but how can the potential be used by the DSPs? Spotify Wrapped is probably familiar to anyone who has ever used social media. The viral power of the campaign deserves its own post full of superlatives, there's no question about that. Looking at the concept in the context of this article, it becomes clear that Wrapped was emotionally engaging superfans even before the major players announced superfan activations.

After proving with impressive numbers (about 50% of all Wrapped stats are shared on social media) that the concept is a stroke of marketing genius, the next step is to monetize the potential and virality. To this end, Spotify has launched several attempts in the 2023 version of Wrapped to convert the attention of (super)fans into something measurable.

In addition to personalized video messages from artists to their top fans, artists from Canada and the USA were given the opportunity in 2023 to offer a merch discount to their superfans for the first time. While this may seem like an insignificant side note to many, it demonstrates that foundational elements have already been trialed in specific markets.

From a technical point of view, Superfan integration on Spotify should pose little challenge, because if you look at the audiobook function, you quickly realize that the infrastructure for unlocking content for a fee is already available.

Player 2: Majors and the attempt to avoid old mistakes 👀

While we can all acknowledge that the current disputes in the industry are far from conducive to the further development of our beloved field, it's not surprising that tough battles arise during times of global power shifts. The Warner Music Group, ranking as the third strongest force among the majors, finds itself in a similar position. CEO Robert Kyncl recently announced that they are apparently already intensively developing an app for superfans, leveraging the company's expertise in the process.

“I’ve assembled a team of incredible technology talent from Google and Stripe and Instacart and lots of other great technology companies who are working on a superfan app, where artists can connect directly with their superfans.” — Robert Kyncl

Only a few details are known so far, but I can imagine that it will go in the direction of HYBE's "Weverse". In short, Weverse is an "all in one" solution, which in my opinion is a sustainable model. Whether made by HYBE, WMG, UMG or a startup. In addition to consuming music, it is also possible to buy merch, watch live streams or read stories about your own K-POP idols. In other words, everything that every player in the game wants to be in the end.

But now back to Warner. Kyncl spoke of a, and this is where it gets interesting, cross-platform solution, as he believes that music is omnipresent and everywhere. I agree, 100%. But would superfan content also be omnipresent if WMG artists only released it via their own major app? Hardly. Of course, Kyncl knows that the DSPs get more screentime from fans than all the major apps put together, which is why they want to harness this power, but want to give up as little power and control as possible in the form of data. As always, this is a balancing act that will probably cost a lot in terms of innovation, as time and money will flow into discussions between the parties involved.

In concrete terms, it could be that we want to buy as a superfan on Spotify, but are then redirected to the WMG app to open an account. I could imagine a kind of "Warner Wallet" that works universally on a wide variety of services - let's see. Of course, it would be cooler for users if everything worked on one platform. But superfans' data is worth its weight in gold, as Kyncl knows. He added that superfans "are generally the people that consume the most and spend the most" and that WMG is "focused on making sure that artists get data on these superfans".

In my opinion, developing your own app is not a serious bid for the crown, but an important trump card when negotiating with the "new king of the superfan world" on behalf of your own artists. I don't think that majors will put the superfan crown on themselves, but are able to choose the new superfan ruler. This applies to at least 50% of the market. The other half is called "indie artists" and is taking more and more market share from the majors.

Player 3: Superfan apps and the wheel of fortune 🍀

I mentioned HYBE and Weverse above. Weverse is probably the most successful superfan app of all. In Q3 2023, the parent company HYBE reported that it had reached 10.5 million monthly active users. Revenues ($15.8m) also read well, with 21.3% growth compared to last year's Q3 sales. But is that enough to claim the superfan throne?

The odds are 50:50. While the company is definitely making gains in important markets and seeing some traction, the necessary mass adaptation is very difficult to achieve, especially outside the core markets. Of course, the partnership between Universal Music Group and the parent company HYBE is helpful, but is that enough to seriously jeopardize the DSP's traction?

If we look at where Weverse's users come from, we can see that 245 countries are represented, but it is also clear that Asia is the growth driver here (of course also through the K-Pop artists like BTS or Enyhpen represented on the app). But to be fair: Weverse also reported significant growth rates in Africa (+46.8%) and the Middle East (+25%) during the year 2023.

BTW: A separate Industry Plant Newsletter on the Middle East market will follow very soon!

In general, it should be clear that Asian fans (especially in K- and J-Pop; see above) are much more interested in superfan content and benefits than fans from Western markets. In these markets, it is first necessary to find a) technological and b) good content solutions in order to unlock the potential. It is clear that the European fan is fundamentally different from the Asian fan. The question is: will artists like Drake or a Spanish rapper get involved with Weverse? Or will Universal perhaps even use the lessons learned from the partnership with Weverse for its own product?

Player 4: The creatives who need to get creative now 🎨

Finally, let's take a look at the independent teams in the industry. There has been a lot of unrest here, especially due to the implementation of the Artist Centric Model, with many artists and distributors complaining about the demonetization of smaller acts.

No matter how long the parties continue to argue, one thing is so certain that it is the most important takeaway from this article: Superfans are and will be an important part for all artist brands out there. The challenge now is to successfully master this discipline with the given tools. This doesn't have much to do with simply selling merch or previews, because the competition is higher than ever before due to the 24/7 accessibility to all music. Your music can be cool, but your character has to be too, in a way that fans can connect with. As soon as we have a functioning technical structure (regardless of which of the players, or indeed everywhere), we need to have a strategy ready for a successful implementation of the superfan theme.

Indie distributors should already start investing more resources in the education of customers, i.e. artists, when it comes to content creation. Because if the distributors also distribute superfan content in the future (which I assume they will), then a lot can be made up for here that has been lost through the introduction of artist-centric. To create a good foundation, it makes sense to do a lot of testing now. In concrete terms, the activation of artists from your own pool, with whom you can carry out professional community building on the channels already available, is a good idea. I don't accept the excuse that there is not yet "THE TOOL". With a little creativity, you can get a lot out of the existing platforms. Here I see players like Bandcamp or Soundcloud in particular in a good position to successfully shape the Superfan implementation in the indie segment.

In summary, distributors need to reinvent themselves and focus on artist development just like the majors. The opportunities for success have never been better.

Player 5: Fans who don't want to die alone on an island 🏝️

Now I've highlighted the various players - there are many roads that lead to Rome, but Rome shouldn't be an island at best. But that's where the superfan (Player 5) currently is. Because if we really want to convince fans of the new music world, we need them to enter it by their own free will. It sounds drastic, but many concepts seem too forced to me. As if (and this applies to all players) the fan has simply been forgotten. Yet we were able to learn so much during the hype phase of Web3.

As some of you know, I founded AMUZED, the world's first Web3 music manager game, with my co-founders in 2021. The principle: a mixture of fantasy sports and music. The vision was born back in 2020 with the big goal of generating additional revenue streams for the industry through gamification. Everyone loves games, right? We combined this approach with Web3 technology (NFTs) to also give fans the opportunity to benefit monetarily from their loyalty to artists. I still believe that a share in the success (paired with gaming) is a great incentive to build an even stronger relationship with your favorite artists. One can assume that the figures quoted by Goldman Sachs for the potential of superfans could be many times higher if a "give and take" principle were to be integrated into mainstream music enjoyment.

What I want to say is that the potential of superfans must not fall victim to quick sales ideas, but the aim should be to increase CLV (customer lifetime value) in order to generate sustainable sales. Currently, I fear that many solutions focus too much on the core group of "superfans". This is a logical approach, but what happens to the other fans who do not fall into this category? Are they left on the island without water while the superfans are picked up by helicopter? We urgently need to create incentives (including monetary ones) for 100% of the fans.

It's very important to me that we don't use this opportunity just to polish up the balance sheets in the short term. That would automatically mean repeating our mistakes. Let me be clear: it is necessary for individual players to take a step back so that we can bring about the biggest change in history. There will be casualties, but it serves the global collective. Many of the discussions we are having today could be ended by a fundamental change in the artist/fan relationship.

What do you think? What will the integration of superfans look like in the future? Let me know in the comments!